But that's over now! The kids should get more experiences than BP. So I

suggested cable car. They were so excited! We were raring to go two Saturdays

ago but it started raining heavily during nap time. So our trip was delayed

for a week. Even though it was drizzling lightly yesterday, we went anyway.

The bus took 50 min. Kai rested with his eyes close towards the end of the trip. Yang dozed off. Yu started complaining that it was "so long" but otherwise remained seated and cheery.

The bus took 50 min. Kai rested with his eyes close towards the end of the trip. Yang dozed off. Yu started complaining that it was "so long" but otherwise remained seated and cheery.

The last time we were there, we started at Mount Faber. This time, we started

at Harbourfront. We went towards Sentosa and came back to Harbourfront. As it

was close to dinner time, we decided to continue our trip after dinner.

We bought tickets on the spot - online :p So much cheaper! And there was no crowd. Love it.

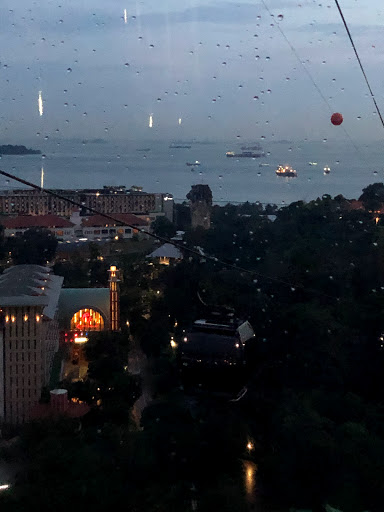

The rain made this look like an old photo!

Taken by Yang :)

The cable cars are all black now. Last year when we were there, there were still colourful cable cars. Yang liked the colourful ones. But he was scared of glass-bottom ones - like the one he took in Taiwan.

Let them have their colouring while waiting for food

Can you guess where?

Morganfield's where kids eat free! Oops, Sito's eyes were closed :p

The younger ones had hotdog rolls plus some steak and ribs

Yang posed for me when he saw me with my camera

Kai had a big burger!

Then we went back to the cable car. This time, more cable cars were occupied and a number had diners - Sito and I had a dinner date there once long time ago :) So we waited a while for our turn, this time going towards Mount Faber and then to Sentosa and back.

Managed to catch the sunset, somewhat...

Thought they had torn down the Merlion but it was still there, with black head...!

That's the Sentosa Line cable car

The boys were quieter now...

Final shot as we left the ticket lobby

Just before we left the cable car, I told them it was time to say goodnight to the cable car! And Yang and Yu began a whole slew of goodnights to: cable car, moon, boat, fart ("coz I farted") etc...

We came home quite late. It was 8.40 pm when we climbed into bed. But they dozed off quite soon after I left. Must have been tired...

Sito and I were also tired!! Gosh!

We thought that Yang likes the cable car ride more than the other two. Especially Kai who kept thinking about having no time for iPad and funny video *.* I think they are either too reliant on digital food or just too 宅 *.*

Hope to bring them out somewhere fun every week! But Sito has to OT alternate Saturdays so just nice - save more major trips like this for alternate weeks :p